[Deep Dive] Long Unity Software (NYSE: U)

Mismanaged and undermonetized leader about to be turned around

Elevator Pitch

Unity provides engines and ads platform for game developers

leader with unparallel one-stop value prop in a low-teens CAGR market

Due to previous CEO’s value-destroying moves like underinvesting core assets, overpaid M&As, and PR disaster, stock went down 88% from the peak

New CEO has the right background in both turnarounds and growth, and is doing everything quick and right to fix issues

Sailed through PR disaster and leveraged the damage into more synergies

Focus is back to the core assets with underperforming units divested

Revenue is set to reaccelerate by regaining lost shares and new pricing

Margin will reach a new high by pursuing a leaner cost structure and more lucrative revenue streams

It presents an attractive Reward/Risk (R/R) ratio = 2.5x

Base case IRR = 20%

Bear case IRR = -8%

Side Note

Like CAVA, this idea is not FULLY original - so huge thanks to

’s write-up on Unity (also if you want to learn more about tech stocks, don’t hesitate to follow this account, will definitely be worth your time!)So, what is Unity?

Unity primarily serves game developers by offering one-stop solutions for the entire lifecycle of a game from creation to promotion. It operates in two segments, Create Solutions and Grow Solutions.

1. Create Solutions (Game Engine + Digital Twin)

This segment provides CAD (computer aided design) solutions primarily for game developers. In simple terms, Unity sells software (game engines) where games are made. It makes money through subscriptions, as well as revenue-sharing or engagement fees.

As a leading player in this space, Unity has dominant market share:

Furthermore, this business enables Unity to build strong expertise in visualization, simulation of real-world physics, and AI (watch out buzzword!!). You can see in this video from 3:50 how powerful a game engine can be by reflecting live changes in snow when the character moves on it.

As a result, such expertise can in fact go beyond gaming, to offer digital twin solutions (reported as Industries) to enterprise clients. Clients in high-risk industries love this offering because they can conduct virtual testing/training with real-life precision at no risk and low cost. A few quick examples:

Airlines simulates air accidents with real-life parameters to train pilots.

Doctors perform simulated surgries to improve the success rate.

BWM runs 95% of all test miles virtually to develop self-driving tech.

See all use cases across various industries on Unity’s website.

When such high-stake but low-risk/cost digitalization beyond HR/accounting penetrates into enterprises, demand is exploding. Even governments, who are well-known for being the last to adopt new things are actively trying it out:

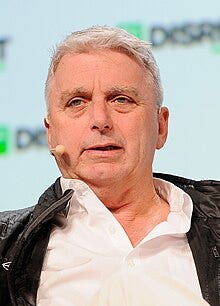

John Riccitiello, Previous CEO at Unity

Now in terms of demand [of digital twin solutions], frankly, we’ve been supply constrained…... There’s a lot of interest in government……

As a matter of fact, it has been the highest-growth business in the company’s history per 4Q23 shareholder letter, currently contributing low-20s% core subscription revenue to Create Solutions segment (vs. high-70s% from game engine).

This business sort of reminds me of ‘s writeup on PLTR:

However, in this write-up, I will focus mainly on gaming business rather than the digital twin since it is still at early stage, which would be a nice cherry on the top instead of a key driver.

2. Grow Solutions (Game Advertising)

This segment helps games to grow through adverstising. It operates like a stock exchange but for ads, connecting both buyers and sellers of ads inventory (think empty space on the app to put ads). It makes money through 3 pillars:

Enables a game to connect with those who have advertising demand so that its ads inventory gets sold to the highest bidder - ~20% take-rate business

Advertises an app in other apps - charge per 1000 installs

Offers analytics and recommendations to grow an app - subscription-based

Please forgive my bad “borrowing” habit, but

has done another phenomenon job walking through gaming ads industry and one of the biggest competitors of Unity’s, Applovin:During FY23, this segment accounted for 61% of Unity’s revenue, up from 49% in FY22, mainly because of a $4.7 billion acquisition of IronSource, another major player in game ads industry.

The rationale behind this M&A, or even this segment, is to provide a one-stop value prop for game developers by covering the entire lifecycle from creation to promotion, which I believe is a major differentiator from competitors on both ends (e.g. Epic Games doesn’t have ads, and Applovin doesn’t have a game engine).

Gaming Industry Overview

1. Growth Trajectory & Outlook

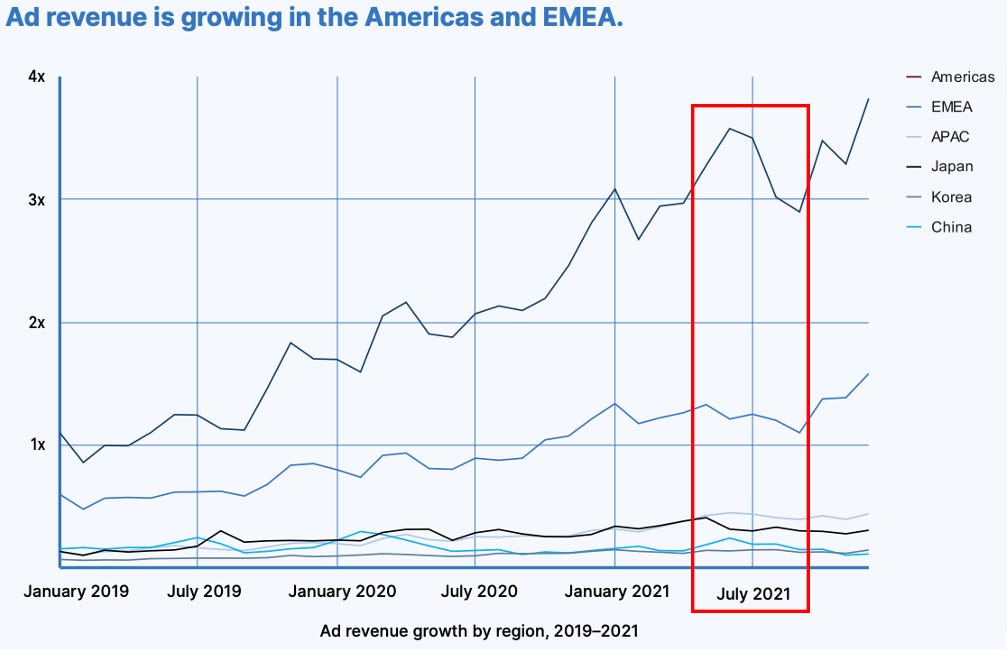

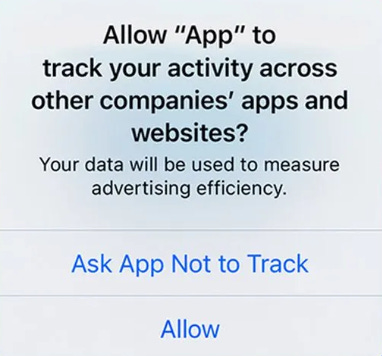

Before 2021, mobile gaming ads had been experiencing double-digit growth acceleration for a while, until Apple changed its app tracking transparency policy. It means the way for app developers to track user data changes from automatic anoymous to permission-based, greatly decreasing the availability of user data especially for advertisers. This led to a huge hit to the whole ads industry, one of the main reasons why Meta lost over 75% of market cap within a year.

On top of that, since pre-COVID, China (30% of global gaming) has introduced a series of policies against gaming due to addiction issues among the teenagers (called gaming “spiritual opium”). It wiped out nearly $80 billion in market value from China's two biggest gaming companies (Tencent & NetEase), and indirectly eliminating value for the advertisers in the value chain. I expect such pressure to ease over time due to China’s slowed economy growth and outflow of foreign capital.

Nevertheless, I believe starting from 2024 the new baseline has been fully reset by both disruptions and the damage have been normalized, with the gaming market set to reaccelerate with new drivers, such as emerging VR gaming (Unity has 65% share) driven by increasing tractions for Apple’s Vision Pro and Meta’s Quest.

The gaming market is expected to grow at 11.6% CAGR from almost $400 billion in 2023 to $1.1 trillion in 2032. Both game content and advertising are growing at similar low-teens CAGR.

2. Industry Landscape & Unity’s Positioning

Gaming Content Development

Market share is very concentrated in this vertical, with over half of market commanded by Unity and Unreal engine of Epic Games, who are good at different things:

Unreal is the best at high-fidelity rendering and advanced graphics, and therefore has dominant leadership in PC, console, especially AAA games.

AAA games is the Hollywood of games. Big budgets, big marketing, big emphasis on graphics, sound, voice acting, and cinema-style story-telling.

On the other hand, Unity is much easier-to-use/deploy/train and friendly to first-timer developers (they can even build games on the web page right now). Thus most entry-level training curriculum/videos is using Unity. Such textbook feature has enabled itself to build a strong moat based on penetration among new developers and switching cost (re-training).

As a result, Unreal leads PC/Console game development, but Unity dominates mobile gaming (69% share) who doesn’t need extremely high-fidelity graphics.

I believe Unity’s leadership on the mobile side has positioned it better for future growth vs. Unreal:

Developing and marketing high end games like AAA is way more complex, expensive, and time-consuming than a mobile games. Even for a top game studio with abundant resources it takes 2-7 years to produce ONE game like that and may not live up to players’ expectation (low ROI).

Mobile games are way easier to monetize by leverageing both ads and in-app purchases, while AAA/higher-end games mainly rely on one-time charge per install or limited in-app purchases (no large studio will allow ads in their movie-like games that cost millions).

This is further proven by below: revenue from ads is growing while purchase is shrinking on a per-user basis.

Also, as odd as it sounds, having ads in the game in fact improves the user retention and engagement (see below). This will further increase the attractiveness of Unity’s one-stop value prop and enhance developers’ reliance on its platform.

Therefore, even large studios (main source of AAA/console games) are starting to pivot to mobile-only games and fuel the most growth there. And Unity will be their first choice for development.

Gaming Advertising

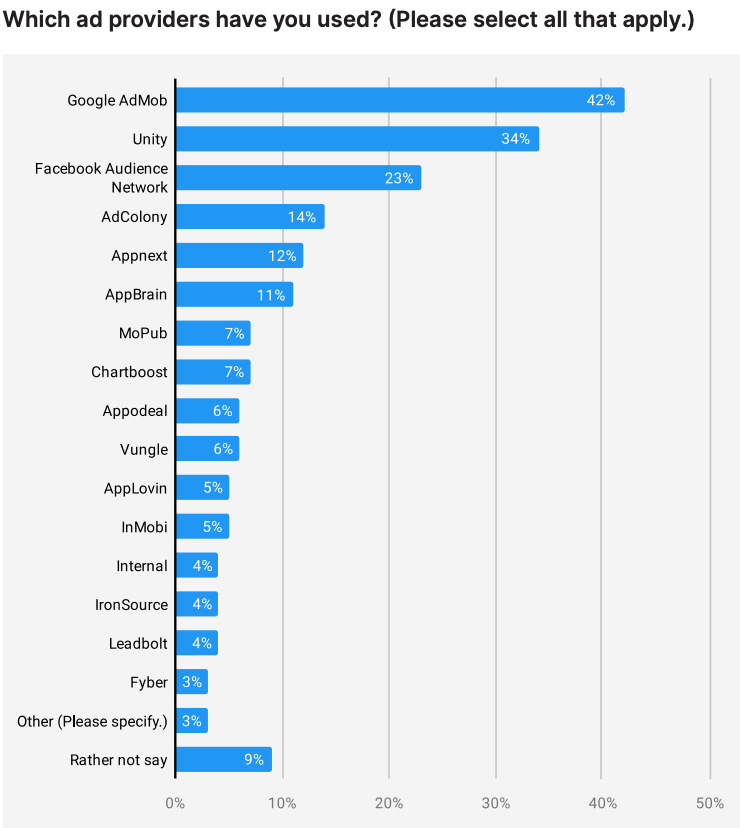

Below is responses to a DeltaDNA survey targetting game publishers across all categories and sizes, quoted by Unity in their 2021 Gaming Report - so potentially cherry-picking. But even at a high level you can still see how powerful Unity’s one-stop value prop is for game publishers, making it an absolute outlier standing in between ads giants like Google and Facebook with unparallel audience reach.

Stock Setup: How Unity Fucked Up

So what on earth could’ve happened to Unity to make its founder to curse, and made market to ignore all its leading positions in high growth verticals and punish it with lower multiples (NTM)?

Growth at No Cost under John Riccitiello

John Riccitiello started as Unify’ second CEO in 2014 and ended his 9-year tenure in Oct 2023. On paper he seemed a solid candidate because he used to be the CEO at Electronic Arts, a leading video game company.

However, when he was at EA, the stock dropped from $60 to $11. In his resignition letter, he mentioned he was “100% accountable” for financial underperformance of EA. After he left, stock rocketed to $145 in less than 5 years.

After digging into his major moves at EA, I found that Riccitiello loved sitting on great IPs like GTA/FIFA without fully monetizing them. Instead he always looked at unnecessary expansion into new verticals with fierce competition. For example, under his leadership, EA tried several times entering online multi-player market to compete against Warcraft at its prime, which obviously didn’t yield anything but wasted a ton of resources.

What’s more, despite his private equity background, Riccitiello made a number of awful M&As at EA, including $860 million for BioWare and Pandemic, $750 million on PopCap, $300 million on Playfish. Up until now, 3 of 4 acquired studios have been shut down by EA, and the 4th has been underperforming.

After he joined Unify, the playbook stayed the same. The strategic focus was spread too thin and the core assets instead didn’t get enough investments - potential was wasted.

For example, post-COVID, its ads business has been lagging behind peers like Applovin since they rolled out advanced machine-learning matchmaking algo one after another. Due to lack of early investment, Unity just struggled to introduce the same-level algo, leading to a share loss to more innovative peers. Even though Unity sits on a gold mine of user/ads data, the progress still kept stagnating for a whole year.

FOUNDER & CHIEF EXECUTIVE OFFICER AT REVX CONSULTING “So this is just 90% of all mobile advertising is bought through programmatic tools, while Unity did not have those rolled out and ready to go. On contrast, AppLovin was very fast out the gates.”

Eventually in 2023, Unity was “sort of” forced to acquire this tech by paying 70%+ premium for IronSource. It was also an all stock deal, diluting shareholders so much (30%+) that it had to take on $1 billion in fresh debt after the deal closed and bought back $2.5 billion in shares to offset SOME of that dilution.

The other acquisitions Riccitiello paid big dollars for also didn’t work very well:

Barron: “So far, Unity has offered little evidence to show that the $1.6 billion Weta deal is paying off, so it isn’t a surprise that investors are skeptical about the deal and whether it can properly integrate the companies.”

While still making right calls, the best decisions Riccitiello made became a disaster……

In the past, Unity’s game engine used to be a pure seat-based subscription product, while major competitor Unreal is employing a seat-based subscription + royalty model started in 2014, where on top of subs it also charges 5% of the game’s incremental revenue above $1 million p.a..

Thus, it cannot be denied that Unity has been under-monetized vs. Unreal. That’s why Riccitiello decided to add a royalty model on top of subs in Sep. 2023:

However, although its 10-year undermonetization (vs. Unreal) should’ve made it easier for cusomers to accept, Riccitiello still managed to find one of the very few unacceptable ways to design the new pricing model:

This new royalty piece included games that are already published, which means games already with quite some installs suddenly owe Unity a sizable payment out of nowhere. It was no different than an ambush for developers.

The royalty is based on install #s instead of revenue. This is an inferior metric because a lot of games either are free and earn $ from ads, or are freemium where install is free but there’s in-app purchases. Therefore, install #s is not accurate or fair to reflect how much royalties to pay.

SENIOR SOFTWARE DEVELOPER AT HELIO GAMES “And the reason it's killing some businesses because some guys just don't get that much money from the one single user/install. So the users/installs come in millions and they don't pay. That's why if you have one million users, you have to pay a lot of money to Unity……”

In addition, the overly complex tier-based calculation and vague communication about how Unity recognizes one install was very vague, and fundamentally broken because Unity only has access to aggregated data instead of specific user case, causing potential problems such as:

doubled-counted single user install on different devices

double-counted reinstall from a single user after deleting

illegal/hacked download that didn’t pay developers in the first place

It was such a PR disaster that even the founder said “we fucked up” in public and Unity had to withdraw the announcement, closely followed by replacing CEO in Oct 2023. Unity also had to cancel town hall over reported death threats (LOL).

You think this is the worst that can happen? Don’t underestimate Mr. Riccitiello. He was also accused of sexual assult, calling certain developers "fucking idiots" in 2022, having a reputation for “squeezing cash out of developers”, etc.

All in all, under his leadership, Unity wasted capital, resources, reputation, and tremenous potential/market share opportunities despite sitting on the greatest gaming assets. His growth-at-no-cost philosophy also led to bloated cost structure with a margin profile significantly underperforming peer.

It is pretty obvious here that my long thesis will be focusing on the turnaround story driven by the new man behind the wheel, Jim Whitehurst

Thesis: Whitehurst and Turnaround

1. Why I have faith in Whitehurst’s background?

In early 2000s, Delta Airlines filed for Chapter 11 triggered by struggled cost-cutting and undermonetization (lowest revenue per available seat mile among all airlines). Leaving as a partner at BCG, Jim Whitehurst around then started in Treasury at Delta. By showing a shockingly strong learning abilities, he then 360-degree pivoted to the Chief Network & Planning Officer (argubly the most important jobs at an airline company) and COO, who was one of the key people who helped Delta to navigate through the storm. Ironically, he left Delta despite being the war-time hero because he was playing a role that was too important for one person to take on in a normal period:

Jim Whitehurst: I was COO but almost all the major functions reported to me other than finance…… He (the new CEO after crisis) basically said, “I can’t have (only) one direct report. I’ve got to have the major functions.” There wasn’t a role for me. He said, “If you want to take any of the roles, pick one.” My role was going away. Honestly, I felt like I had been kicked in the gut. I was deeply involved in the day-to-day for two years through that bankruptcy”

Thus, in 2007, Whitehurst moved on to be the CEO at Red Hat, an enterprise software company. In this completely different playfield, Whitehurst nailed it again by making the small company 10x bigger and a part of S&P500 in 10 years, despite the mandate changed from restructuring/operations to growth/innocation.

In 2019, he even managed to sell Red Hat to IBM at a 63% premium for $34 billion, the biggest transaction IBM has done, and the second biggest M&A in software industry till today! After that he also became the president at IBM to oversee its expansion into cloud and reacceleration from revenue slowdown.

Overall, I see Whitehurst as a:

Strong crisis manager - he was also one of the first people Delta CEO called to come back after 9/11).

Best-in-class CEOs for growth/software companies - he’s also an advisor at Silverlake, one of the best technology private equity companies out there.

Those two convictions perfectly aligns with where Unity is at right now: a high-growth software company that is undergoing a crisis.

On top of all that, there is one cliche thing I’d like to highlight - culture. By reading Whitehurst’s book and watching all his interviews, the most impressive stories about him are always around how he built the culture vs. corporate strategy. Here is the example that impressed me the most:

“One time my wife called me. She rarely calls me [when I’m in] meetings. With a group of people in the conference room, I said, “Excuse me for a second. My wife normally doesn’t call me. Let me step out real quick.” I stepped out to talk, came back, and thought nothing about it.

Five years later, at a sales rewards club meeting, this is where the top salespeople come in, one of the women there came up to my wife and said, “I was about to resign from Red Hat five years ago because I was pregnant, and I wasn’t sure Red Hat would work [for me]. I was in a meeting with your husband, and you called. He stepped out to take the call. I thought, ‘If the CEO believes that it’s important enough, that family comes first, this is a company that I want to be a part of.’”

All in all, by looking at Whitehurst’s background, I am very close to be convinced that he should be the perfect one to take over and fix Unity.

2. What has Whitehurst done right so far at Unity

First of all, he sailed through the PR storm around the new pricing plan by updating it into:

the new pricing model will only apply to new games rolled out after the announcement, isolating existing games from the extra charges.

the controversial royalty piece of the pricing plan will charge whichever is the lower between:

fees based on monthly new installment above the threshold

2.5% of revenue sharing for those with $1+ million sales (vs. Unreal’s 5%)

Both actions made sense and put out the fire of PR disaster, especially the the 2.5% revenue sharing that undercuts Unreal’s 5% by 50%, remaining strong price-competitiveness and a big step up of monetizing Unity’s game engine (vs. 0% before).

Secondly, Whitehurst accurately realized the most powerful weapon Unity owns, aka., the hard-to-resist one-stop value prop (engine + ads).

The specific strategy he employed to maximize the cross-selling opportunities was brilliant too: developers can opt the “disliked” royality fees into credit that can be spent on Unity’s ads offering, so that developers don’t feel like paying more money to Unity, instead getting their games more promoted and grown, while Unity cross-sells more and further strengthens customer stickiness.

Thirdly, he moves quickly on integration and finally makes timeline visible.

We already mentioned how Unity was “forced” to buy IronSource to make up for the ads business falling behind peers on algo-driven matchmaking. Shortly after Whitehurst took over, the integration was accelerated and finished by 4Q23. Now competitive gaps are closed, Unity is set to win those lost shares back in the second half of 2024:

Jim Whitehurst in 4Q23 Earnings Call: Just to be blunt, last year, we were doing a lot of integration with ironSource and Unity…… I do think that level of distraction kind of put us a bit behind. That's now behind us. We have the teams integrated and we have a plan that I think we're very confident in. It closes any competitive gaps that we have.

Mid-level Game Content Developer At Janus Research Group: In Q3, Q4 (of 2024), I expect them to actually be able to match AppLovin's performance.

Fourth, opposite to Riccitiello, Whitehurst brings strategic focus back to core assets, focusing on profitable growth:

Divested unprofitable businesses like Luna to minimize distraction.

Sold more competitive but less profitable professional services piece of digital twin business to Capgemini, but kept the more lucrative subscription- and consumption-based revenue streams.

Exit the hardware components of multiplayer business.

Reduced 25% of workforce, and expected to cut $250 million operating expenses in addition to stock-based comp and CoGS.

All these business exits totaled $283 million in revenue in 2023 and operated at a significant adj. EBITDA loss. Thus, after those exits, revenue is set to reaccelerate and margin will benefit from the accretion.

Overall, I believe Whitehurst is doing everything quick and right to fix issues at Unity, turning it into a gaming oligopoly positioned in the most lucrative parts of the industry with renewed focus, unparallel value prop, and pricing advantages to fully capture high-growth runway and lost market share.

Valuation - 2.5x R/R

COMPS

Here is the list of COMPS and why I picked them:

CAD (Computer Aided Design) software focusing on 3D and simulation

ANSS, ADSK, DSY, BSY, CDNS, PTC, SNPS

AdTech

APP, TTD

Digital Twin

PLTR

It is hard to find perfect COMPS for Unity because Epic Games who owns Unreal engine is not public. But CAD software can act as a reasonable peer group given highly similar offerings (2D/3D simulation, subscription-based software, etc.) but different end markets.

As shown above, on a multiple basis, it is not hard to see that Unity is significantly undervalued, for almost 50% against peers’ mean/median.

Stock Set-up

I believe its multiples were overly punished because:

The gaming industry recession triggered by Apple’s new privacy policy and China’s moves against games among teenagers

now baseline has been fully reset and damages are behind us

Riccitiello’s several wrong strategic decisions destroyed massive value, leading to loss of market share and waste of resources/potential

Total Customers with $100K+ Rev (LTM) saw the yoy decline (-3%) first time ever in Unity’s history in 4Q23

Dollar-based Net Expansion Rate (LTM) has been below historical low (120%) since 3Q22, reaching the bottom at 102% in 3Q23

But new CEO seems promising to turn the ship around

Key Drivers

Revenue: poised to see mid-teens to 20% CAGR in the next 4-5 years

mainly driven by low-teens end market growth (new games and more ads spend)

facilitated by low-/mid-teens from re-focusing on core high-growth businesses, synergies & market share catch-up, the new pricing model, and the digital twin business

Adj. EBITDA Margin: 16% in FY23 (already 30% in 4Q23) → mid-20s in FY24 → 30% in FY27

mainly driven by aggressive cost-cutting which can double FY23 EBITDA:

$274 Adj. EBITDA in FY23 vs. ~250m FY24 OpEx savings (in addition to CoGS/SBC cutting)

accretion from portfolio optimization and op. leverage

exits of low-/negative-margin businesses

refocusing on higher margin businesses with low-hanging synergies

Dilution: 386 FDSO by 4Q23 → 500 FDSO by 4Q27

still a software growth company, so assuming 6-7% dilution p.a.

2027 Multiples:

peers’ avg. = 8.7x

peers’ avg. = 19.6x

Both valuation multiples led to ~$27 billion EV by 2027. Assuming 6-7% annual dilution (still needs to be careful about a software growth co.), it presents a base case IRR at 20% in N4Y.

I believe the R/R is very asymmetric here because in bear case, even if I assume the following, bear case IRR is only -8%, presenting a 2.5x R/R:

Revenue CAGR = 7%

gaming end market’s low-teens CAGR almost doubles Unity’s

implying significant market share loss due to continuous churn against new pricing model, or industry underwent another downturn

Adj. EBITDA margin fell to 8% vs. 16% in FY23 (200bps margin depreciation p.a.) despite $250m cost-cutting

extreme failure of new pricing model or AI disrupts and commoditized the space

unsustainable cost-cutting

low ROI on increasing R&D

failed M&A/integration

A 20% discount on both revenue and EBITDA multiples

Catalyst

I don’t think this will be a particularly fancy event-driven idea, so not too much about catalyst here. But generally, potential multiple expansion can be witnessed in:

Any future earnings/conferences where Whitehurst showed promising progress on turnaround, revenue reacceleration, synergies, and cost cutting

Guidance raise, earnings beat

Outperformance of large accounts’ games’ sales

Growing customer counts with $1M sales - more royality revenue

James M. Whitehurst has been appointed Interim Chief Executive Officer, President and a member of the Board.

The Board will initiate a comprehensive search process, with the assistance of a leading executive search firm, to identify a permanent CEO.

It seems as though Riccitiello didn't step down, but was pushed, leaving a gap. Riccitiello was CEO, Chairman and member of the board, so it was a big gap. Hence the interim appointment.

If Whitehurst is only in office for a short time, his credentials are far less important than those of the permanent appointment that is yet to be made.

I wonder why Whitehurst didn't want the job on a permanent basis. Any intelligence?

Thanks for the comment!

It seems that they already picked a new formal CEO, Matthew Bromberg. He used to be:

1. COO at Zynga, a mobile game developer/publisher, where he oversaw turnaround of the firm and ran global game studios.

2. SVP at EA running its global mobile gaming biz.

Overall, I really like his experience, even more relevant to Unity’s bread and butter (mobile games) vs. Whitehurst. So this appointment is definitely a positive to me, for now.

As for Whitehurst, he is returning to Silver Lake as a MD. So I guess his biggest interest at this moment is PE investing and helping portfolio companies grow.

Meanwhile, Whitehurst didn’t technically leave Unity but instead is appointed as executive chair on the company's board of directors, staying on to provide guidance, which may be because Silverlake is one of the largest shareholder of Unity.