Business Model

Royalty Pharma (RP) is a pioneer of royalty financing to biopharma industry with 53% market share. In exchange of a part (normally MSD to LDD%) of drugs’ future revenue, RP offers a third way for biopharma firms to get financing other than raising equity and debt, and below is why royalty is a more attractive option:

The 2 biggest considerations are zero dilution and full control over the drug pipeline, after all nobody wants big pharmas to come in and Vaulter (sorry Kendall Roy) your life’s work as a <1% R&D writeoff.

RP has always been run as an extremely capital-efficient machine. In 2019, before going public, RP only had 35 employees (only 13 in research and investment + rest in G&A) but deployed $2.3 billion capital to acquire royalties and generated over $1.8 billion Portfolio Receipts (cash receipts from royalty) at 91% EBITDA margin and 85% FCF conversion. It also has compounded cash (royalty) receipt at low-teens and paid $0 tax since 2012 as a PFIC.

Now a public co, RP has better and cheaper access to capital to go offense in an underpenetrated industry (details later). Below showed perfectly how this enabled RP to operate under greater capacity (5x’d pipeline too). Meanwhile, despite all the extra momentum, RP still maintains great discipline given lower delta of transaction $ vs. in-depth review #s=> even lower review-to-deal conversion ratio vs. pre-IPO.

The first thing it did after IPO was a huge dry powder recharge: $6 billion issuance of senior unsecured notes at 2.125% weighted avg. coupon with maturity around ~12.5 years. Given its investment grade rating plus ~$50 billion healthy term loan history, RP managed to keep its current $7.6 billion debt’s coupon as cheap as 3.1% even though current Fed rate is at 5.13%; only 25% of RP’s cheap debt is maturing before 2029.

Low cost of debt is a very distinct competitive advantage, enabling RP to underwrite bigger returns under the ROIC>WACC framework, thus RP’s “bid” will always be competitive vs. other royalty buyers. This is the reason why RP maintains over 50% share in the biopharma royalty acquisition industry (77% share in $500m+ deals), with the second player at only 13% share.

When comparing to alternatives, 1) debt financing, no bank will lend money so cheaply without strict covenants, or at all, for a pre-approved biopharma venture. This is when RP jumps in, as a sophisticated, trusted, and diversified middleman, to borrow money cheaply from banks, “lend” to biopharma, take the downside of debt servicing, in exchange of a % of future revenue, then the spread in between becomes its net return. 2) equity financing, no investor / big pharma partner will only ask for revenue sharing without ownership dilution and control/interference. Both comparisons make royalty an almost no-brainer choice for biopharma firms. As shown below, the less than 2% conversion from demand to done deals further proves that RP can more than afford to be picky/disciplined, and royalty is indeed a supply-contrained resource:

Underpenetrated Investable TAM

RP’s $2.2 billion capital deployment in 2023 is a pretty big number and naturally introduced a question around how much biopharma funding is there left for RP to provide. The answer is: TOO MUCH. This is because the investable universe is virtually all biopharma R&D spend, which is estimated to be a $4 trillion opportunity over the next decade - on average $400 billion a year, which RP is only 0.5% penetrated right now. Even if we only look at the $1 trillion bubble from unprofitable biopharma, which has the lowest likelihood to self-fund like Pfizer or receive grants from governments like universities - thus the easiest to penetrate into, it still presents $100 billion/year at only 2% penetration.

Another piece of evidence is funding breakdown by sources as below, assume biotech funding peak in ‘20/’21 and the trough until today roughly offset their impacts on the equity % mix, royalty as a funding source is outrageously underpenetrated at 3%.

Therefore, the key message is the $2.2 billion royalty transactions RP did in 2023 doesn’t even cover the tip of the iceberg. The penetration will go up for sure given the superior tradeoff paradigm royalty has vs. equity/debt. So now, the question shifts to: how penetrated can royalty be within biopharma funding, does sky have a limit here? I am not specialized enough to answer at all, but we can gain some helpful colors from some precedent in the last few years:

Select Therapy/Biotech’s Total Raised Capital % Breakdown by Funding Source:

Based on 4 disclosed breakdowns (blue font) and 10 educated estimates (backed by credible sources vs. 20+ other un-estimatable ones that I didn’t include here), we can get a rough sense of how high the incremental royalty penetration is. Despite the large s.d., it signals a very exciting terminal state of royalty penetration in biopharma funding industry, if the biotech funding keeps growing, which it will.

If we only use the bottom sample ~12%, still 4x of current penetration

If all my estimates are wrong (decent probability they’re, but I did it anyways in case the disclosed ones are cherry-picking), averaging 4 disclosed’s yields a 22% (23% median) incremental penetration, over 7x today’s 3%

If my estimates are right, 33% avg. (31% avg. without top and bottom 3 samples; 29% median) incremental penetration become the blue sky scenario, ~10x today’s level

All in all, there should not be any concern r/ RP running out of its investable runway soon. Instead, the penetration will be a structural key driver behind its growth algo going forward, especially after PTSDs led by the frozen biotech capital market post-COVID.

Hit Rate & Slugging Ratio

As shown above, 62% of RP’s investments are in the “safer” territory - approved drugs, ready-to-monetize, getting paid immediately after writing the cheque, while the rest is increasingly dedicated to bet on potential approval and commercialization of development-stage therapies. Compared to approved ones that just needs size market right, the other demands way more: stronger risk apetite for uncertainties around regulation, more concept-driven analysis, and identifying unmet needs and new markets. Higher risk of course brings higher expected return (teens vs. HSD-low-teens => blended low-teens avg. return consistently).

So, you might want to ask, what’s their track record, or hit rate, of invested development-stage therapies being successfully approved? From 2012 to 2022, RP’s hit-rate is 79% by the count of investments. This is very impressive, since the best hedge fund manager only has low-50s hit rate. But that’s not all. This summer I learnt a new term, slugging ratio, aka. you bet big when you are right and size the wrong decisions small so that your dollar P&L is much stronger than nominal hit rate. A high slugging ratio leads to impressive returns even when you’re only right half of the time - that’s the secret sauce of successful PMs. This is perfectly reflected in RP’s case too - 79% hit rate by count, but 95% hit rate by value!!

This stat stands out even more when compared to the industry average end-to-end approval rate 9%, phase 2 drug’s 21%, and phase 3’s 59% (most RP’s development-stage investments are in phase 2 and 3). Even Pfizer, which during COVID had an unprecedentedly number of regulation green lights, could only achieve 21/52/85% in 2020, while only at 9/15/70% pre-COVID (source).

On top of approval rate, # of blockbusters (annual sales >$1bn) can also be a good indicator to management’s selection skills pre-/post-approval. As shown below, RP has a portfolio of blockbusters even more than big pharmas’ median. And it is not just bigger, but also more diversified exposure to all high-growth niches, ranging from cardiology to psychiatry, from neurology to cancer, etc.

All in all, we now get a business that almost does not suffer from any downside of drug development (capital intensity of running R&D, labs, trials; uncertainty around approval), but enjoys the full upside of its commercial potential - thanks to the top-tier management team.

Return on Investments

Alright, we are now at the last step of the top-down framework: investable TAM → royalty penetration → royalty market share → conversion rate from investment to money makers → actual returns on the royalty investments.

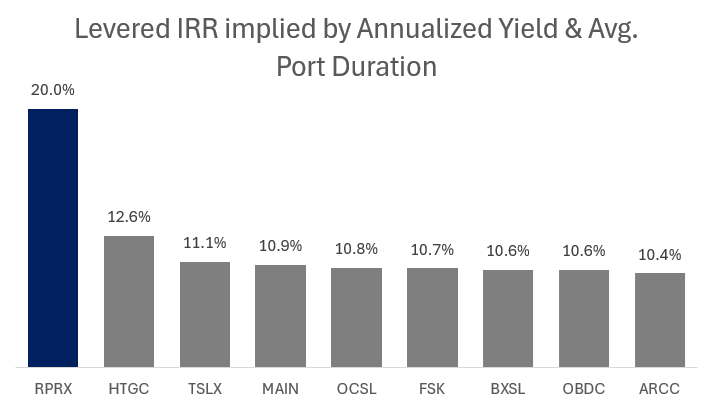

As above, RP has a shockingly consistent low-teens unlevered IRR on its investment in the past decade or so. Then with conservative leverage funding 1/3 of royalty acquisitions, it gets lifted to ~20% - see below. This is a rather impressive return profile, even in-line with private equity’s target despite more conservative usage of debt. If RP can scale to a point where they are comfortable funding investments w/ 50% debt like a vanillia PE deal, then levered IRR can scale to ~30% under low-teens unlevered IRR and LSD interest rate.

Valuation (here we are, finally…)

Terminal Debate

Every stock has fundamentals that drive earnings, and narratives that drive multiple, multiply them together - boom we get the valuation. In RP’s case, the fundamentals are awesome, high quality business driven by T0 management team who keeps delivering. However, none of the earnings growth were appreciated by the market, instead, the stock price has been overwhelmingly dominated by multiple conpression (see below). Now the stock has tanked to a half of the IPO price, trading at 6.58x NTM P/E.

It turned out near-/medium-term earnings growth was not what went wrong, since most therapies in RP’s portfolio are well understood and forecasted. It is the therapies that’s not in the portfolio yet, it is the sustainability of earnings growth after drug patent expires, it is about whether this company deserves a TERMINAL VALUE, which is 60-80% total value in a DCF output.

When calculating terminal value, we normally put a 2% terminal growth into perpetuity, but that’s questionable for biopharma royalty. This is because the underlying asset, therapies in this case, create the majority of its value for only 13 years (RP’s weighted average portfolio duration) before patent protection expires and generics come in eating everything on the table. Therefore technically, RP will have no “asset” left after 13 years - it just cannot grow into perpetuity passively like normal businesses.

You have to admit this argument makes a lot of sense, especially compared to other royalty businesses, such as music, mining, or the famous MJ-AJ deal, that are at least 70-100 years long, RP’s portfolio duration of 13 years does justify a multiple discount:

The thing I don’t agree with this consensus is: the magnitude of the multiple discount seems too much. My reasoning for this will draw so much criticism that I can already spider-sense them coming, but I am saying it out loud anyways:

My Pushbacks to the Discount Magnitude

This section is NOT a lazy valuation (will approach it in a much more scientific way later)

If the lack of perpetual asset and passive value creation, or overreliance on management’s active (re)investment with consistent ROIC, is the root cause behind terminal discount, then why is market not punishing Blackstone and KKR of the world, which trade at 20-30x P/E?

After all, those publicly-traded megafunds have no ability to generate value passively without its people actively investing behind the scene. Their valuation is supported by 1) expected value creation from current portfolio (near-/medium-term) and 2) public trust on their people’s investing skills to drive future investments’ return (terminal value).

Although the businesses/assets BX/KKR acquired do have a normal terminal value unlike RP’s royalties’ underlying therapies, we cannot underwrite those portco’s terminal value as part of BX/KKR’s because they cannot hold them forever but have to sell them at the end of the fund life (avg. 5-7 years) so that they can give the money back to LPs as promised. This leads to a shorter passive value creation period, with a even lower IRR generated at higher leverage vs. RP:

I know…… a lot of you might argue: “there’s fundamental differences in their business models! BX is a fee-earning business, profiting from both AUM and performance, the former is more predictable cash flow……” But if you really think about it, the classic 20% performance fee is just like the % revenue-sharing mechanism in royalties, both driven by the acquired assets’ financial growth. As for the 2% management fee, yes it is passive value creation, you could do nothing while still earn the 2% of AUM. But again, you have to raise new funds every 5-7 years, there is no way you can sustain your fund size or fee structure if you sit on your AUM passively without actively investing through one whole cycle - so this so-called predictable cash inflow can only sustain 5-7 years passively instead of into terminal.

It is undeniable that BX or other megafunds deserve a premium over RP, due to more asset classes, diversified sector exposures, shiny brands, and ability to keep attracting top investment talents (what really drives terminal value), etc. But are these factors justify a ~80% multiple discount? I don’t know……

For instance, RP doesn’t have to worry about asset class saturation / crowding like megafunds do, given the underpenetration of royalty financing in biopharma industry, so I don’t see much value-add of asset class diversifition here. Regarding sector concentration, it is understandable that people might worry about RP’s high correlation to a volatile sector, but the truth is: every time biopharma is hot, RP’s investable universe will expand and growth accelerates, while every time biopharma falls out of favor, capital gets pulled out, it becomes easier for royalties to penetrate due to a lack of alternatives. So, RP can benefit no matter which biopharma cycle it is. As mentioned earlier, RP almost does not suffer from any uncertainties/volatility in drug development, but enjoys the upside of all commercial potentials, making it a very uncorrelated biopharma play.

What exactly is market thinking now?

It turned out megafunds are not the only publicly-traded “investment vehicle”, there is an inferior (to some extent) version of them, BDC (Business Development Company). BDCs’ investment mandate focuses on short-duration mid-market credit lending across the entire spectrum from investment grade to high-yield. So I pulled a quick BDC COMPS - boom, magic happens! Suddenly RP finds its real “family”, assigned by Mr. Market of course.

However, as shown below, RP has doubled BDC’s levered IRR with lower leverage and lower cost of capital. The only possibly more attactive part of BDCs’ business model is they have to distribute at least 90% of taxable investment income to shareholders, making their dividend yield north of 10% vs. RP’s 3.2% - but that itself doesn’t fill the double-digit gap of IRR, let alone dividends’ tax inefficiency and RP’s way better reinvestment runway. Moreover, BDCs are also dealing with a lot of risky & highly-levered portcos, versus the promising monopoly therapies in the high-growth mode handpicked by RP’s tier-zero management team.

Therefore, categorizing RP as a BDC is clearly not appropriate but merely reverse engineering from the already underwhelming stock performance. After some digging, it turned out UBS first suggested RP should trade in-line with BDC - caveat: RIGHT AFTER its stock hit another ATL on May 30th this year, seems like just another sellside extrapolation…… (source)

Bear Case

If after all these ramblings, you are still not convinced - let’s go to the extreme:

Force RP management not to reinvest any FCF going forward, thus absolutely NO terminal value

Assume all development-stage therapies in the portfolio will never be approved

Only factor in its approved therapies’ cash generation from FY25 to their earliest patent’s expiry date (e.g. go with the first patent’s expiry instead of the entire patent wall’s). Because I am no expert of biopharma, so the future therapy sales estimates are using:

VisibleAlpha consensus - many therapies’ only lasts to FY27 but more or less signals which growth/shrinkage stage they are at now

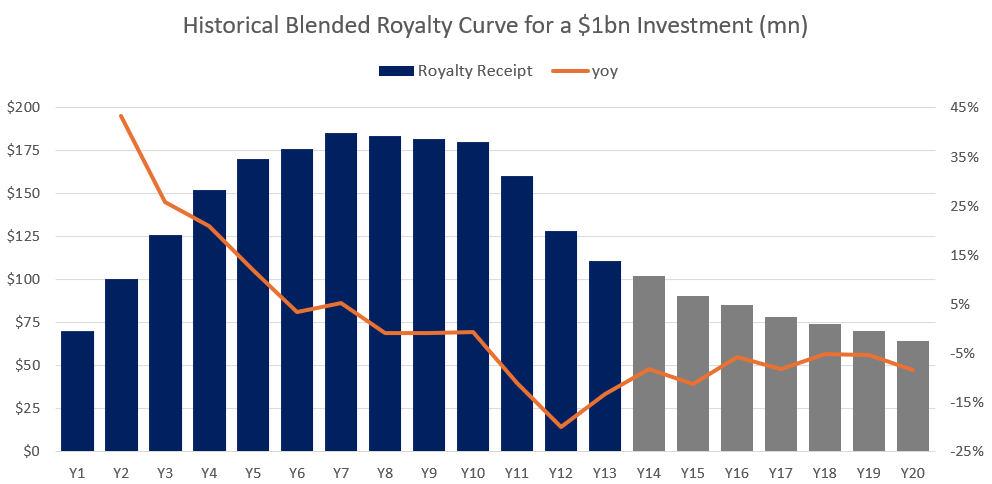

Beyond FY27, apply the yoy growth from the historical blended royalty curve of all past therapies (see below), and assumed zero royalty after Y13, aka., after patent expires, therapies will lose all its revenue to generics immediately (despite the curve suggesting otherwise).

The output is below: there’s only 2-3 royalty standing in FY37, in which they will be expiring at year end. Keeping 89% FY23 FCF margin (generous to pay out 11% expenses since no reinvestment is done and RP’s only a cash collector) and discounting at 7.5% cost of capital (higher-rates scenario), we still get a Net Present Value (NPV) of $13.1 billion, 11% higher than its current market cap of $11.7 billion (all #s here are for Class A financials and shareholders).

Although I have been already VERY punishing when contructing this bear case, the output still suggests a moderate upside, which is usually a sign of not being bearish enough……

There are flaws to this approach of course. For example, it fails to capture the “keep reinvesting but IRR deteriorating so badly that it’s worse than not reinvesting at all” scenario. But with current management, I struggle to see the materiality of this scenario if weighted by probability. Or another instance, where a strong alternative (not generics) emerges and murders the consensus / guided #s, like what Brukinsa did to Imbruvica that eventually entered decline stage earlier than the curve despite its 2029-2032 patent expiry. But again, this is a very rare case, and the diversification (only 1-2 therapies account for >10% royalty receipts) of RP’s portfolio can greatly limit the negative impact.

Base Case

We finally finished the “why undervalued” part - now let’s talk about what it “should” be valued at. Before starting, huge credit to @crestone on VIC - their framework of normalizing RP’s earnings power is super helpful.

As mentioned, the biggest challenge of measuring RP’s earnings power is around its sustainability, aka. terminal value. In the base case, we will give RP management the benefit of doubt on keep reinvesting at attractive ROIC-WACC spread just like the market does BX/KKR, and bake the perpetual reinvestment piece in the earnings algo as a form of Maintenance CapEx. The general idea is to find the needed spend to keep reproducing cash flows.

As shown below, we simulated a one-time normalized RP investment:

Time horizon is 13 years = RP’s average portfolio therapy duration

Set Y0 EBITDA at -100 as the cash outflow (investment), and link Y2-13 EBITDA to Y1 through yoy growth from RP’s historical blended royalty curve

Goal Seek 13% IRR on the EBITDA curve, with Y1 EBITDA as the plug

Use stable EBITDA margin to backsolve revenue

Cumulatively, one $100 investment can convert into $245 revenue and $226 EBITDA

So, in order to keep reproducing its cash flow under historical return, RP needs to spend Maint CapEx as much as 41% of its revenue p.a.

Next, we work through FY25 P&L, substracting Maint CapEx as an expense, and get Cash EPS and Real P/E. Now, after adding this necessary burden (a ~50% haircut on earnings and doubles P/E) to sustain terminal value creation, RP is still trading at a very low 12x FY25 P/E, a 23/55% discount vs. big pharmas/megafunds:

Therefore, if RP ever trades as a business with a terminal value, or simply in-line with big pharmas, which is not a stretch at all given its clearly better business model, multiple expansion alone can drive ~30% return. If it matches megafunds’, which (hot take!) I think it deserves given better return profile under lower leverage and longer runway, that’s ~120% upside. But to be realistic, if a multiple re-rate was to happen, the market will probably settle around high-teens (ATH 19x in 2021), call it 18x => ~50% upside.

As for upside driven by earnings surprise, there’ll be several sources:

First, therapies that was recently approved deliver above-the-curve growth. Take Trodelvy as an example (shoutout to @perspicar744 on VIC): it is expected to be a >$1bn topline contributor, 4x the initial investment vs. 2.45x indicated in the base model because:

RP-owned IMMU shares get bought out by GILD and the gain alone made the deal profitable in less than 1 year

its 2028 sales forecast expands from $2.1bn to $2.8bn (33%) because of indication expansion into other cancers

Alright I know what you’re thinking - “this is such a one-time homerun, you cannot underwrite this in all future deals!” I agree with the second half, so I am not doing that, but I disagree with the one-time part, this is not a blackswan event but rather happens quite often in RP’s portfolio:

For instance, Tremfya:

First approved for plaque psoriasis in 2017, then approved for psoriatic arthritis in 2020, global #5 sales for psoriasis in 2021

Recently approved for ulcerative colitis, consensus sales lifted by 35% since RP’s investment in 2021

just passed Phase 3 and waiting for FDA/EMA decisions for Crohn’s disease, which is estimated to be another $15bn opportunity by 2032

Another example is Nurtec ODT and Zavzpret from Biohaven:

RP invested $760mn (equity + royalty) since 2018, according to our base case model, it should convert into a 2.45x or $1.86bn revenue

However, RP already received $915mn payments from royalties and Pfizer acquisition of Biohaven, on top of $525mn milestone gains, totaling $1.44bn or 77% of base-case target already, within THE FIRST 5 YEARS

then with Nurtec ODT’s expanded indication into episodic migraine that 40mn Americans have, we are looking at 2-3% royalty on a >$6bn peak annual sales for the next 12 years

Here, I am simply highlighting the fact that the basecase model can be a bit punitive on the growth potential, especially when it comes from indication expansion which introduces both sales upside and prolonged duration. This is perfectly reflected in the upward revision of consensus sales (see below), while the market is still reluctant to reflect it in the stock price.

The second source of earnings upside is just new approvals of development-stage therapies since our Bear Case exercise suggests market is basically baking in zero new approvals in the current portfolio. This is the catalyst-rich territory, which I am supposed to focus on especially after the painful lessons on my CAVA short and U long (valuation is NOT a THESIS ;-; ) - but, I am no biopharma expert, I simply don’t have a single clue how FDA or EMA is gonna do. So, I guess this is one of the “art-more-than-science” moments where I wisely quit predicting the unpredictable…… Nevertheless, I still managed to seek comfort from RP management’s impeccable hit-rate and slugging ratio track record (recall: 95% approval rate by value). Update after election: Vivek’s future involvement in the DOGE can be a net positive for new FDA approvals because as a biotech entrepreneur and investor, he has been vocal about his belief that regulatory bodies like FDA impose excessive restrictions that hinder innovation.

I know, I know, you are not satisfied with my answer again, but there’s something else that could make it interesting: I was reading the terms of all the recent development-stage deals, and spotted something new in the deal structure, like the one with Teva’s TEV-‘749:

On FDA approval, Royalty Pharma receives total amount funded paid over five years; in addition, Royalty Pharma will receive a low- to mid-single digit royalty.

If Phase 3 data is positive but Teva decides not to file with FDA, Royalty Pharma immediately receives 125% of amount funded.

This peaked my interest because this mechanism guarantees the full recovery of RP’s initial investment post-approval regardless of the therapy’s actual sales performance and potential threat from alternatives. Moreover, it also guarantees a 25% return if not filed for FDA - a huge alignment of interest when you are dealing with big pharmas like Teva. In fact, TEV-’749 just reported positive Phase 3 results in 2Q24, which translates to a 47% IRR if Teva decides not to go head-to-head with Zyprexa Relprevv. Although it does not solve the core risk of not getting approval, it does mitigate out almost all other risk associated with development-stage therapies.

When it comes to deal terms, people always complain about RP capping their upside at 1.5-3x MoM in a number of deals. However, it’s not that hard to picture: as royalty becomes more penetrated as a supply-constrained resource in biopharma funding, RP starts getting more favourable terms like the TEV-’749 one and start lifting the upside limit over the long run. Who knows, maybe if we eat healthily and work out regularly, we might actually live long enough to see a “refund” structure for a FDA rejection……

Back to the main topic, a few therapy-specific catalysts to pay attention to:

Capital Allocation & Balance Sheet

management is commited to 3% dividend yield, with MSD growth

for the first time since IPO, RP started buying back stock from last year, currently halfway through its $1bn repurchase program. If stock stays depressed, it’s a no-brainer to expand it to multi-billion buybacks because this is now a stock with 17% nominal FCF yield, or 8% normalized cash earnings yield according to our math, with a LSD cost of borrowing

Balance sheet looks healthy, almost 30x interest expense coverage ratio, ~2.5 net leverage, all investment grade and the majority is maturing after 2028

not that RP will do it, just math for fun: RP’s N3-4Y FCF combined can pay down all debt and buy back all class A shares at current price.

Ending

Given my very limited knowledge in biopharma sector, I consider this write-up yet another brave (or naive) venture into the unknown domain - hopefully not my last try.

I still feel like there is so much more content to be added, such as the dispute vs. Vertex r/CF Triple, deal-by-deal analysis (the MOR development funding bonds look pretty interesting to dig into), therapy-by-therapy modeling, implicit bets behind this stock (rate sensitivity, biotech cycles, DJT administration).

But to be brutally honest, I am just too lazy to get into them right now - I really need to enjoy my last year of not working and work through my video game backlogs. Maybe I will keep a casual pace of learning about all these topics and post updates once a while, but for now I am gonna end this write-up here, thanks for reading, it’s a long one so appreciate your patience!!!

BTW those are two primary sources that help form my views - definitely go check them out and follow “the sheep” if you are interested in this sector: