Before diving into anything, first I want to give credit to Lauren Balik who has done a great 2-piece research on CAVA (article 1 & article 2), both of which inspired me a lot and was the foundation / source of my thesis on union, labor, and potential health crisis. Also huge thanks to Kian Ghazi’s previous write-up on Sweetgreen, which provides countless valuable insights in the industry and expert quotes.

Investment Summary

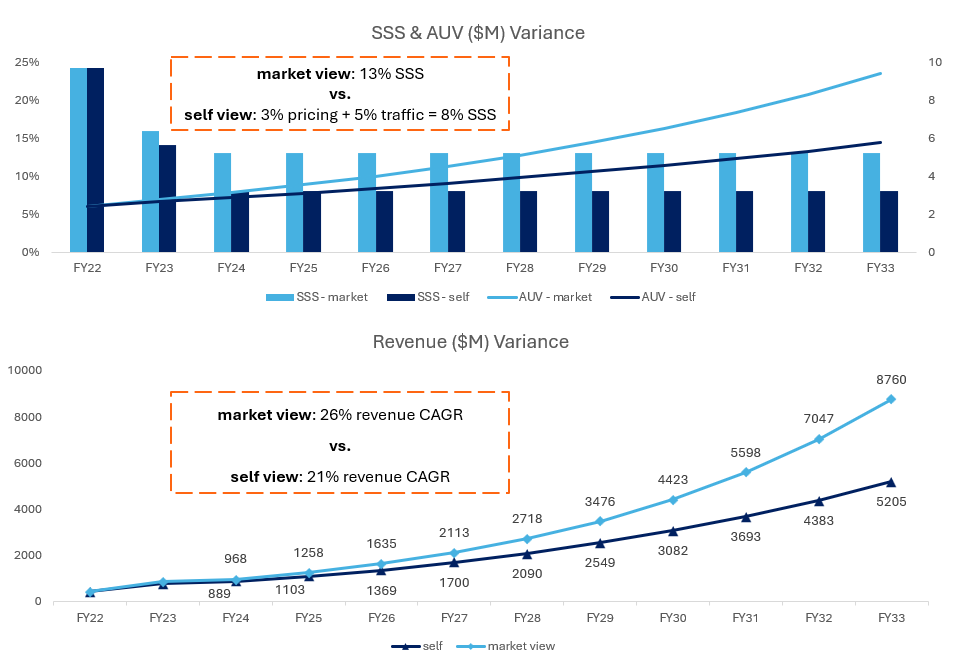

1. Eroded growth runway and SSS algo

Market is excited about CAVA’s urban growth runway (only 18% store count right now), while operating in urban is structurally challenged because of WFH disruption and serving a demographic that CAVA isn’t used to

Even in suburban where CAVA is deeply rooted, it is already underperforming national players who just entered, proving that its brand is not as strong as it seems, and it stood out in suburban on growth/margin only due to minimum competition in its category

The 20%+ SSS algo is already broken when COVID normalization fades and aggressive price raising exhausts next few year’s pricing power – SSS will fall back to HSD = MSD traffic volume + LSD pricing.

2. Increasing ROIC and margin headwinds

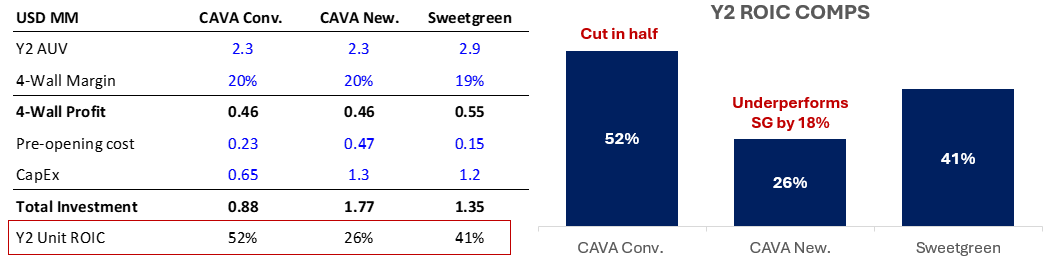

Most “new openings” since FY18 have been conversions from acquired stores, which only cost half time/cost of new build. From 4Q23, all conversions will be finished – ROIC will be cut in half and incremental operating costs will inflate

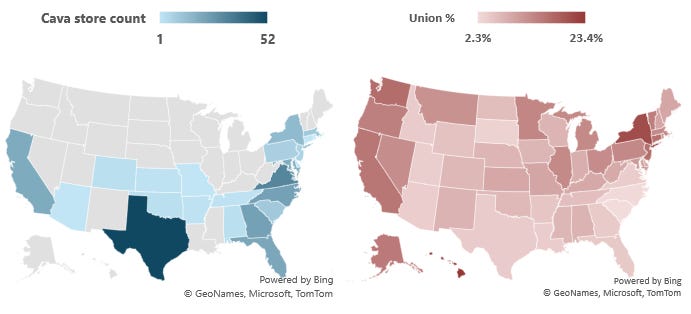

CAVA is underpaying employees by 20% vs. peers to gain better cost structure, but it is an unsustainable/losing strategy and will be disrupted by itself expanding from conservative states into union-friendly states

3. Potential health crisis

CAVA has reached expansion speed ceiling and started cutting corners on store operations just like Chipotle in 2015

Its store health grading has deteriorated and is underperforming average restaurant in a whole city.

The marketing content is near to “no adult in the room”, e.g., encouraging customers to ignore lactose intolerance.

4. Asymmetric Reward/Risk Profile

Market is baking in 21% revenue CAGR and 45% operating profit CAGR for the next 10 years – which requires everything to go right and beyond, seems way too optimistic

My own DCF valuation implies 85% downside and 29% upside, aka., an attractive 2.96x reward/risk ratio

Based on 2026 EBITDA estimates and multiple, we are looking at a 3-year IRR at 18.5%

The hype around “the next Chipotle”

FORMER GENERAL MANAGER, SWEETGREEN

“CAVA is aspiring to be the next Chipotle but the Mediterranean style.”

CAVA is a fast-casual restaurant chain which offers Mediterranean foods. As of October 1, 2023, it owned and operated 290 CAVA restaurants in 24 states and Washington, D.C..

SR.ANALYST, BAIRD RESTAURANTS RESEARCH

“CAVA possesses many of the same attributes that has made Chipotle the best growth asset in our coverage over the past 17+ years, still a top pick.”

Bulls view it as the next Chipotle given the same assembly line, build-a-bowl-or-wrap offerings, along with proven store expansion playbook + strong unit economics. The hype is also centered around how large, high-growth, and underpenetrated the TAM is, driven by heathier diet change primarily.

In the past 6-7 years, CAVA has witnessed way higher store unit growth than close peers, with its CAGR more than doubling the second, further validating bulls’ thesis on high-growth and underpenetration, leaving CAVA as one of the most exciting growth stocks in the restaurant sector.

As a result, CAVA’s NTM multiples got absolutely bloated (i assigned higher weights to the first 3 comps):

So what is baked in the stock price?

As of my writing, CAVA was trading at $54.7/s, based on which I did a quick and dirty reverse DCF, whose output is below:

This teaches me, in order to justify current stock price, CAVA is expected to deliver:

Mid-teens same-store-sales growth + low-teens store count growth = 21% revenue CAGR

45% Operating Profit CAGR or 114bps margin lift p.a.

And it can keep doing this for next 10 YEARS!

It needs EVERYTHING to go right and probably beyond to make those happen, so seems quite a bit stretch for me, especially after I dive into my theses.

Thesis 1: eroded top-line growth runway & broken SSS algo

CAVA BULLS: “CAVA has significant growth runway into urban whitespace where consumers earn more and eat healthier.”

However, this urban runway is not as lucrative as it seems.

Mid-Level Executive, Direct Competitor of CAVA

“our suburban [volume] is closer to 120% vs. FY19, while urban residential stores are closer to 80% and urban business district is only 50%… Now we are realizing Mondays and Fridays are probably permanent WFH days, which will be the reality for at least next 2-5 years…

It looks like urban’s store traffic has been struggling to recover to pre-COVID vs. suburban due to the trend of WFH, which cuts corporate card expense and lowers office workers’ store traffic.

Moreover, urban serves a highly different demographic because a big part of urban sales is from work lunch, while CAVA is used to 45% dinner sales mix. This could become a potential headwind when CAVA increasing its urban presence depending on how it navigates the disproportionate lunch traffic and uneven shifts for lunches vs. dinners.

Meanwhile, CAVA’s suburban share is not safe.

As shown above, CAVA has been heavily overweight on suburban. I believe this enabled CAVA to avoid fierce competition because suburban areas are less attractive for big national players (less awareness of healthy diet and lower average income), leaving fewer customers with much fewer options to pick.

Sweetgreen at Morgan Stanley Consumer Conference (Dec 2022)

“For the past few years, our pipeline has been majority (85%+) suburban.”

Nevertheless, such tailwind will diminish soon because direct competitors are quickly shifting expansion focus from dense, urban areas to suburban (I suspect this is because of the outperformance of suburban vs. urban post-COVID mentioned above), and outperforming CAVA on both fronts!

CAVA has exhaused pricing power for next few years and will have trouble to maintain current level in the untapped geo

As shown above, the dream-level SSS in the past 3 years was fueled by COVID volume normalization and unsustainable price raising. As a result, CAVA consistently sits at the most expensive end of pricing across major items and locations:

This will pose a huge threat given their focus of new geo expansion:

CAVA IR: “we plan to increase density in our existing markets, while expanding into new geographies, especially Midwest.”

C-Level Executive, a Fast Casual Chain

“Maybe rents are lower, but Middle America won’t pay $17 for a chicken bowl or $12 for a salad. There are many healthy concepts in the suburbs that charge $10.”

Moreover, I believe the traffic part of CAVA SSS algo is unsustainable not only because of fading COVID normalization, but also due to increasing store density in existing markets has started to cannibalize its own unit AUV:

Store Employee in Dallas, CAVA

“we used to make $10k/day, now it’s barely $5k due to 2 new stores opened next to us”

As a online delivery-heavy business (over a third of digital revenue), the density-driven expansion next to existing stores make even less sense. I think this kind of irrational, ROIC-dilutive expansion playbook is because CAVA’s desperate to align with bullish narrative and keep its store expansion momentum. On top of conversions (see thesis 2), most “real new openings” were done in FY22/23. So, by FY24, a lot of them will reach mature AUV level and show the real consequence of cannibalization in the numbers soon.

What thesis 1 looks like in the operating model?

Thesis 2: increasing ROIC/margin headwinds

CAVA BULLS: “CAVA is the only chain that can maintain attractive unit economics when expanding new openings at 49% CAGR store count.”

But, new openings are not that new after all

In 2018, CAVA acquired Zoes Kitchen for $300 million. Then CAVA started converting (re-designed, re-renovated, re-menu-ed, re-streamlined) Zoes Kitchen units to CAVA units, reporting as “new openings”.

Upon that acquisition, Zoes Kitchen was more than 3 times bigger than CAVA (261 stores vs. 70 stores). As a result, the whole conversion thing accounted for 71% new openings since 2020.

Here is when things get interesting, even though conversions are counted as “new openings” at CAVA, it costs significantly less to convert vs. a new build:

SVP, Design & Construction, CAVA

“Converting a Zoes over to a CAVA is about less than half the time in active construction and half the cost [of a new build].”

As a result, I have high conviction that CAVA has leveraged all those conversions to boost up new openings’ unit economics and store-level ROIC, which masked the true underperformance vs. peers. A further comparison is shown below:

Such unit economics/ROIC “tailwind” will disappear going to 2024 because all Zoes Kitchen conversions will be finished in 4Q23. Going forward, management is still guiding 15% store count CAGR, which will be fully new builds and I believe will considerably “dilute” current “superior” unit economics/ROIC:

And also something on labor costs……

CAVA BULLS: “CAVA’s cost discipline and operating leverage turned operating margin positive in 2023, and it will inflect higher.”

I disagree because CAVA has shown some distinct difference from peers’ cost structure which I think is not a structural advantage:

Some people might argue back: maybe CAVA is just as good as Chipotle and so it runs a better labor cost structure vs. SHAK/SG! However, in my mind, Chipotle achieves the lowest 24.6% because of scale, but CAVA’s 25.3% is purely driven by underpaying employees - as shown on RHS above, CAVA has been underpaying employees by double digits on a dollar basis, which is not sustainable and even if it is, this is a losing strategy (underpay to gain better cost structure):

Former Director, Chipotle

“I would say labor has become the biggest threat to the bottom line, particularly in large metro areas, rising minimum wages, even higher market value for entry-level has pushed us to increase prices to a point where it becomes less of a value.

So whatever fast-casual company wants to be successful, it takes more than just great food and marketing. You must have the best people but need figure out a way to make that economical.

Furthermore, this pain point on labor costs will face more challenges once CAVA keep expanding to their geo whitespace:

As you can see here, CAVA’s store footprint concentration is nearly the opposite against unionization concentration by state. It implies that CAVA’s current units are mostly in union-unfriendly Republican states, where it can navigate through underpay issue more easily. But once it starts penetrating into the exciting growth runway or geo whitespace, especially Midwest that was frequently mentioned by IR/C-suite, the cost structure will face tremendous pressures and see more scaled and quicker wage inflation.

What thesis 2 looks like in the operating model?

Thesis 3: potential health crisis

First, this is not really a “model-able” thesis, but definitely something that is worth close attention to, given a perfect precedent happened in 2015 to Chipotle:

From mid-2000s to mid-2010s, Chipotle was expanding like crazy with consistent double-digit store count CAGR. However, it went into a health crisis from 2015-2016, after which the store count CAGR never got back to double digit again. The following is a timeline of that crisis:

Aug 2015: 200+ cases of norovirus were linked to a Chipotle in Simi Valley, CA, including several Chipotle employees testing positive for norovirus

Sep 2015: 64 people in Minnesota across 22 Chipotle restaurants were sickened by Salmonella caused by tomatoes at Chipotle

Oct 2015: 43 Chipotle locations in Oregon and Washington were closed after an E. coli outbreak that sickened 50 people

Dec 2015: 140 people were struck with norovirus after eating at a Boston-area Chipotle, after an employee was allowed to work while sick

As a result, stock price got hammered by 70% and it took 4 years in total to get back to 2015’s peak:

Key Takeaways here:

There is a ceiling to how fast any restaurant chain can grow net footprint year over year

The higher YoY storefront growth is, the more corners get cut on operational excellence at existing locations

Public image damage will cost far more than financial performance to recover in food sector

okay, now back to CAVA and how it is almost replaying Chipotle in 2015

Take its 16 NYC stores, probably the biggest AUV generators, as an example, CAVA’s health grading has declined considerably:

So, out of almost 24,000 restaurants in NYC, 93% of them are clean enough to be graded A, while out of 16 CAVA units in the same city under the same standard, half of them failed to deliver so.

I can imagine CAVA fans will defend like this: “Many urban units have a disproportionate number of digital or pick-up orders for which customers do not have to visit the physical store, so the impact may not be that serious at all!”

But remember, this also applies to all other 23,000+ A graded NYC restaurants, therefore, a better explanation is: “CAVA already reached the expansion speed ceiling where it cannot maintain such pace without cutting corners on operations, just like Chipotle in 2015.” - recall CAVA’s whopping 47% store count CAGR in the past 6-7 years.

In addition, one of the major reasons why I think this will lead to a health crisis instead of improvement is CAVA’s attitutes towards these health degrading:

The timeline of health degrading of this particular stores shows even more shockingly negative attitudes of CAVA:

May 17, 2023: it scored a “C” with 44 health violation points.

August 15, 2023: it scored a “C” with 71 health violation points upon re-inspection, even worse.

October 2, 2023: it scored a “C” with 52 health violation points upon re-inspection. It was cited for failing to display their “C” grade and was shut down by health officials.

October 10, 2023: It was re-inspected to reopen and passed, but still maintains a “C” grade.

Also, CAVA’s marketing can also be a trigger of a health crisis

As you can see above, CAVA is super active on social media / influencer marketing. But the content looks really sus - it is basically urging consumers to ignore lactose intolerance for their feta cheese. Here is what their feta cheese is made of:

Greek and EU legislation: “Greek Feta cheese must contain a minimum of 70% sheep’s milk and no more than 30% goat’s milk”

As you can see cow’s milk is listed as the No.1 ingredient, which makes it mathematically impossible for sheep’s milk (No.2 ingredient) to be a minimum of 70%. Given a lot more lactose in cow’s milk vs. sheep’s milk, CAVA’s feta cheese is much easier to trigger lactose intolerance that it urges customers to ignore……

Catalyst

Valuation

Overall, it presents 2.96x assymmetric Reward/Risk Ratio & 18.5% 3 year IRR

Will update more details on catalyst, short interest, valuation assumptions, excel model, etc. after my midterms (fingers crossed!).